net investment income tax 2021 proposal

What You Need to Know About President Joe Bidens Tax Proposals. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service.

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Top marginal rate is 37.

. The federal government imposes a 38 net investment income tax on the investment earnings of single taxpayers who earn at least 200000 and couples who earn at least 250000 and file joint. There is a phase-in range that creates some pretty interesting range calculation patterns. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

The investment income above the 250000 NIIT threshold is taxed at 38. Keeps the qualified. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Expanding the net investment income tax. April 2021 Learn how and when to remove this template message On 2 May 2018 the European Commission presented its proposal for 2021-2027 multiannual financial framework A modern budget.

Big Changes to Come. High-Income Surtaxes Taxpayers will be assessed a 5 surtax on. July 21 2021.

The proposal would impose a 3 tax on a taxpayers modified adjusted gross income in excess of 5. Net investment income tax. This proposal would be effective for tax years beginning after Dec.

A the undistributed net investment income or. 38 surtax on net investment income over applicable threshold. The proposed 18 trillion American Families Plan AFP would represent a sweeping overhaul to the US tax system that could impact individuals.

38398 for Philadelphia residents. Net Investment Income Tax NIIT Expansion. Limiting the Section 199A deduction for qualified business income.

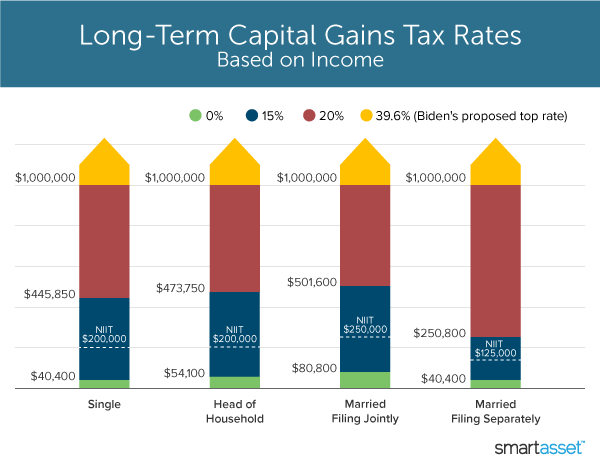

November 3 2021. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. The income level that this capital gains rate bracket applies to would be aligned with the new 396 rate bracket.

Effective September 12 2021 with exceptions for pre-existing contracts. Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT. The proposal would increase the capital gains tax rate for individuals earning 400000 or more to 25 from 20.

Unveiled by President Joe Biden on April 28 2021 the plan is part of the Build Back Better policy initiative joining. Expands the 38 net investment income tax for taxpayers earning over 500000 married filing jointly and 400000 single filers to include all pass-through income above and beyond investment income and wage income no change here. A Married Filing Jointly household has 300000 in income from self-employment and 10000 in dividends.

The proposal expands the scope of the NIIT to include all applicable income regardless of whether or not the taxpayer is a passive. Senator Wydens proposal removes the specified service trade or business and W-2-wagecapital investment limitations but phases out the deduction for taxpayers. For estates and trusts the 2021 threshold is 13050.

3 surtax for ultra-high earners with MAGI exceeding 5 million threshold applies to both joint and single. All of the dividends will be taxed at 38 for a total of 380. B the excess if any of.

This change would be effective as of September 13 2021 subject to binding written contract exclusion. Fortunately there are some steps you may be able to take to reduce its impact. House Ways and Means Committee tax proposal September 13 2021.

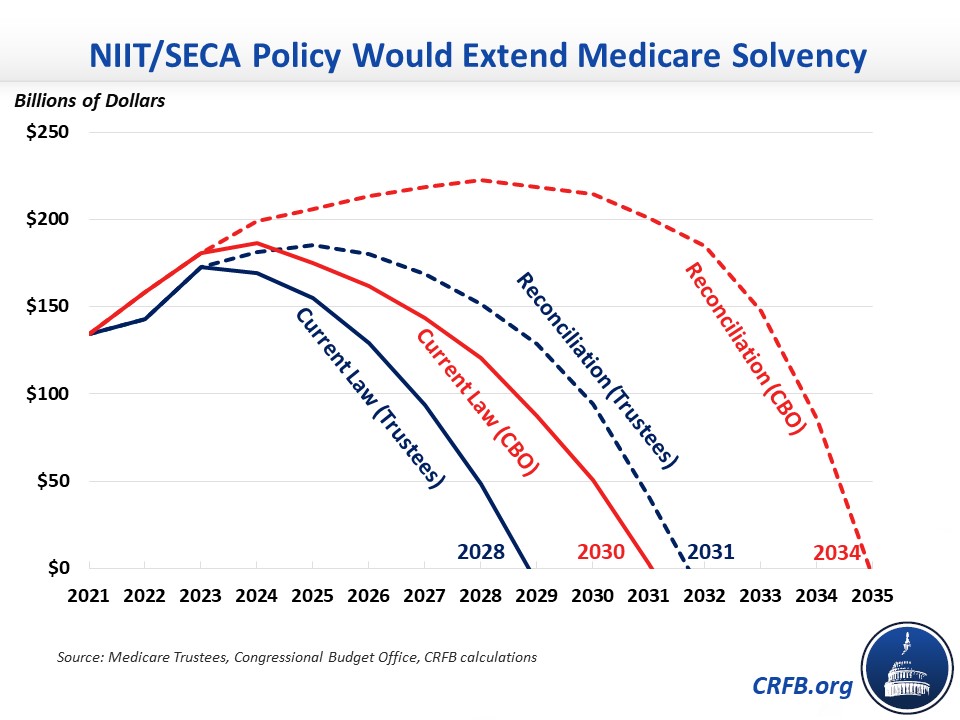

The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and expansion of the 38 net investment income tax would be effective beginning in 2022. Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to 25 from the current rate of 20. You can explore various options for your unique situation using our new and improved.

Thai Income Tax Bands 2021. New Income Tax Slabs Rates for FY 2021-22 AY 2022-23. PART II--Medicaid Provisions Sec.

The NIIT would now cover net investment income derived in the ordinary course of a trade or business for taxpayers with taxable income greater than 500000 joint filers and would also apply to trusts and estates. In the case of an estate or trust the NIIT is 38 percent on the lesser of. D-OR in the Small Business Tax Fairness Act introduced in July 2021.

By Richard Yam JD.

What S In Biden S Capital Gains Tax Plan Smartasset

House Ways And Means Committee Tax Proposal

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

House Democrats Propose Hiking Capital Gains Tax To 28 8

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

What Is The The Net Investment Income Tax Niit Forbes Advisor

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

House Democrats Propose Hiking Capital Gains Tax To 28 8

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

House Democrats Tax On Corporate Income Third Highest In Oecd

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Reconciliation Could Improve Medicare Solvency Committee For A Responsible Federal Budget

Income Tax Increases In The President S American Families Plan Itep